Weak international results aside, Amazon posted another powerhouse quarter, with total sales up 29 percent year over year to $56.6 billion, and net income up over 1,000 percent, to $2.9 billion, for the three months ended Sept. 30.

Once a perennial money pit, the e-tailer-cum-Cloud computing giant can’t count its bounty fast enough now. Here’s where it came from in the third quarter:

Online sales, including Amazon’s own physical goods and digital products like books, music, videos, games and software, brought in $29.1 billion for the period, an increase of 10 percent. Online still represented the largest chunk of revenue, more than half, at 51.4 percent.

Watch: Amazon Accelerating Private-Label Brands

Brick-and-mortar sales, including the Whole Foods supermarket chain and the dozens of Amazon bookstores, pop-up shops, checkout-less convenience stores and new 4-star showrooms, generated $4.3 billion for the quarter, or 7.6 percent of sales.

Third-party services, which includes sales commissions and fulfillment fees from marketplace sellers, brought in $10.3 billion, an increase of 31 percent, and accounted for 18.2 percent of net sales.

See also: 88% Of Smart Speaker Owners Have One Of Amazon’s

Subscriptions, including Amazon Prime memberships and e-book, audiobook and streaming services, came to $3.7 billion, or 6.5 percent of net sales, and grew 52 percent for the quarter.

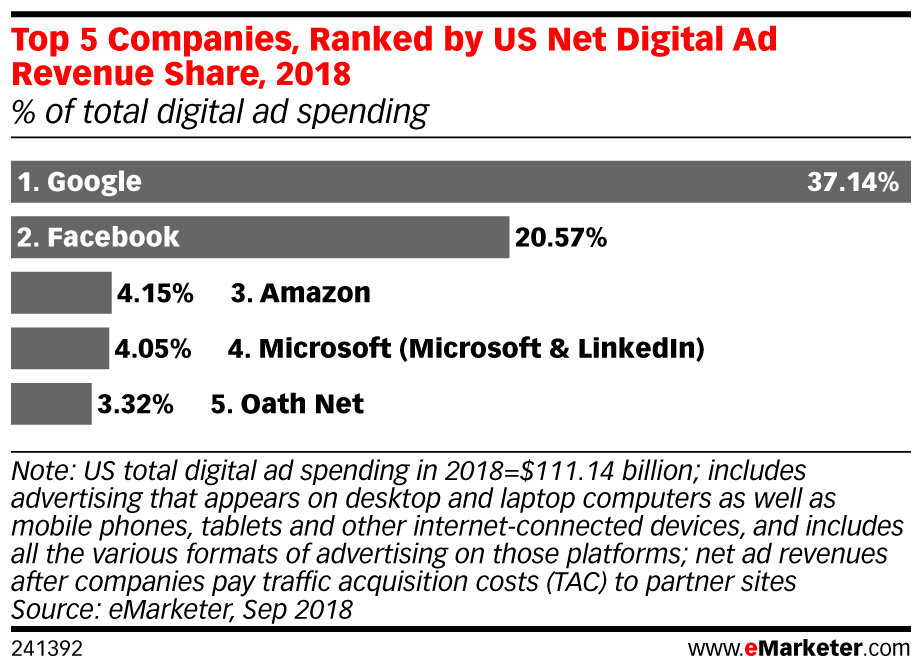

Digital advertising, which is Google’s bread-and-butter but is still a nascent business for Amazon, pulled in $2.5 billion for the period. It represented only 4.4 percent of net sales, but grew a whopping 122 percent year over year.

AWS, Amazon’s Cloud-computing ace in the hole, was good for $6.7 billion, an increase of 46 percent. And while it only accounted for 11.8 percent of total sales, its profitability puts retail to shame. Operating income was up 77 percent, to $2.1 billion, and operating margin was 31.1 percent, compared to 5.9 percent for its North American retail operations.

Although the stock took a quick hit on weakness overseas, analysts with a longer-term view warned competitors to be afraid, be very afraid.

“While topline growth fell short of Wall Street’s expectations, it’s hard to ignore that Amazon is still growing at an impressive rate of 29 percent year over year on a massive $56 billion in revenue,” observed eMarketer principal analyst Andrew Lipsman. “Meanwhile, the excellent bottom-line results highlight ongoing momentum in the Cloud and advertising businesses that continue to fuel strong margin expansion for the retail giant.”

Scott Mushkin, managing director and senior retail/staples analyst at Wolfe Research, was more blunt. “A profit-generating Amazon should terrify competitors,” he wrote in a research note, “as it gives Amazon a significant [amount] of ammunition to acquire businesses, provides the opportunity to invest in price for its [own] products, or scariest of all, become a price-setter in food to drive share and frequency.”

“It’s in Amazon’s DNA to innovate and disrupt industries,” Mushkin added, “and to think that the company will sit on its newfound cash windfall and let growth flounder is foolhardy.”