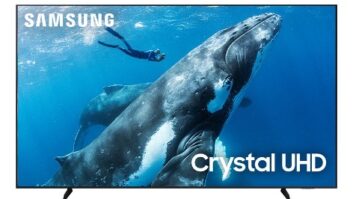

Rogers, Ark. — TV is Sam’s Club’s largest CE category, and 4K is quickly becoming its dominant display format.

So said Dawn von Bechmann, technology and entertainment senior VP for the 650-store chain, and her boss, executive VP and chief merchandising officer Charles Redfield, during a visit to Walmart’s home turf here this month during shareholders’ week.

Also on Sam’s CE agenda: Ultra HD adjuncts like 4K Blu-ray players and camcorders; a whole bunch of Bluetooth speakers; and even a smattering of drones for the chain’s prototypically inquisitive and acquisitive customer base.

Here’s a rundown of what’s hot and what’s not (or at least not yet), at the world’s No. 2 warehouse club:

4K TV: “It’s an important part of our business, and we’re seeing it really coming to life,” von Bechmann said, as pricing approaches the company’s sweet spot. “Our members love new technology and big TVs.”

Indeed, the category already represents 20 percent of Sam’s Club’s TV volume and 35 percent of its SKUs, she noted, compared to a sales mix in the high-single digits to low teens for the industry. As a result, average TV selling prices at Sam’s are on the incline, vs. an 8 percent average annual decline for the video business at large.

Looking ahead, the Circuit City vet projects that UHD displays will comprise as much as 50 percent of her TV mix by the holiday selling season, fueled also by fresh content from Netflix and the Hollywood studios, and the addition of 4K camcorders and Blu-ray players.

3D Printing: The retailer is currently rolling out its first model, by MakerBot, to all of its clubs and will begin offering five SKUs online.

“Are we selling a lot of 3D printers?” asked Redfield. “No, but I can tell you that we’re learning a lot about it, and how it’s used.”

So far, most of the interest is coming from small businesses, schools and architectural firms, von Bechmann said, rather than the consumer channel. “It’s still in its infancy, and there’s no killer app yet, but our members expect us to have the latest technology, and we want to be in place before it goes mainstream.”

Sam’s Club also serves as a barometer for Walmart, she noted, where new technologies and adoption patterns can be assessed before going mass.

Connectivity: A tough nut to crack, acknowledged Redfield. “I’m not sure anyone’s figured out how to do it successfully yet, including us, but we’re working on it,” he said.

“It’s a tough value proposition to articulate at retail,” added von Bechmann, who had earlier trialed a connected-home display within the clubs. But Sam’s will give it another try in August, this time with Google and Nest backing it up.

Wearables: “Apple Watch has helped the wearable category,” von Bechmann said. “It’s a completely different value proposition, but it has sparked interest.”

Bluetooth audio: “Audio had been in the doldrums as traditional audio struggled,” she said. “But there’s been an explosion in Bluetooth speakers, which have become smaller, better-sounding and have additional value-added features, like being waterproof.”

In the process, they’ve also grown into Sam’s Club’s third-largest CE category.

Mobile: The No. 2 tech category for Sam’s after TVs, wireless got a major boost last year when parent company Wal-Mart acquired cellular services provider Simplexity/Wirefly. The move supported Sam’s decision to take mobile activations in-house after outsourcing them to RadioShack, and gave the chain a head start on the competition when carriers switched to installment payment plans.

“We went from 40 minutes to under five minutes for phone activations, with much less fraud,” von Bechmann said.

Drones: The high-flying tech toys adorn SamsClub. com’s first-ever print catalog, and von Bechmann expects to begin stocking drones in select clubs by holiday.