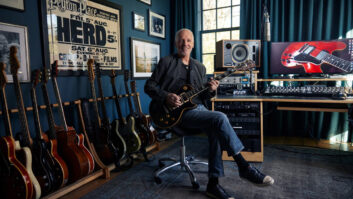

If you feel you are being taken advantage of when you pay extra credit card processing fees, you aren’t alone. According to WalletHub’s 2024 Credit Card Processing Fees Survey, 85% percent of people feel they are being nickel-and-dimed when paying credit card fees, with half of Americans responding that they won’t even use their credit card if it requires an extra fee. Here are some of the key findings of the survey:

Key Stats

- Fee Fatigue: 85% of people think they are being nickel-and-dimed when they are asked to pay an extra fee to process a credit card payment.

- Very Common Problem: 79% of Americans have been charged a fee for paying with a credit card.

- Credit Card Boycott: Half of Americans say they will not use their credit card if they have to pay a fee.

- Transparency Concerns: 48% of people feel that merchants are not transparent when charging fees for credit card transactions.

WalletHub Analyst Cassandra Happe has broken down some of the survey’s findings, and their repercussions to both consumers and retailers. The following is an excerpt from a Q&A session Happe took part in to contextualize how extra credit card processing fees impact the industry:

How do Americans feel about being charged extra to use credit cards?

“Americans do not like being charged extra fees to use credit cards, with 85% of people saying they feel nickel-and-dimed when it happens. It’s currently legal to add surcharges for credit card transactions in most states, so most people still need to carry an alternate payment method, like cash or a debit card, to ensure they don’t waste money on processing fees. Half of Americans will still use a credit card even when charged an extra fee, though, due in part to the convenience of credit cards and rewards that can offset fees.”

How common is it for merchants to add a surcharge for credit card payments?

“It’s relatively common for merchants to add a surcharge for credit card payments, as 79% of Americans say they have been charged this type of fee. Merchants are charged a fee by the credit card networks every time they perform a credit card transaction, so many places try to pass that cost back to consumers by charging more. For example, you’ll typically see gas stations charging more for payments made with credit compared to cash or debit cards.”

How transparent are merchants about charging fees for credit card transactions?

“Roughly 48% of people feel that merchants are not transparent when charging fees for credit card transactions. It is concerning that people don’t think businesses are transparent, because merchants who charge more for using credit cards are required by law to clearly communicate that to consumers before they make a purchase. This could indicate either that merchants are not following the law, or that they are complying in a way that is not clear to the average person.”

How will the recent settlement agreed to by Visa and Mastercard affect consumers?

“If approved, the Visa and Mastercard settlement, which aims to reduce the processing fees they charge merchants, is expected to have a limited impact on consumers. The current settlement proposes a modest reduction of 0.04 percentage points for a minimum of three years. Merchants are unlikely to pass on their savings to consumers, however, and the settlement allows them to apply varying surcharges for different types of credit cards, with rewards cards facing higher penalties. Only a small segment of consumers who use cards that merchants prefer may benefit from the reduced fees.”

See also: How New Sustainability Trends Are Redefining Retail