Amazon’s Alexa seems to be [listening] everywhere.

It’s nearly impossible to utter her name without waking up a nearby speaker, TV, or some other newly attentive device. According to Strategy Analytics, Alexa-enabled devices hold a 61 percent share of the smart speaker market in the U.S., followed by Google Assistant at 34 percent. IDC estimates that Alexa can control more than 20,000 devices and Google only around 6,000.

See also: What Is A Smart Home?

“This is because Amazon has first-mover advantages with its release of Echo devices, and also making its Alexa Voice Service SDK broadly available to device makers,” explained Adam Wright, IDC’s consumer IoT senior research analyst. “Both Google’s and Microsoft’s SDKs are still being previewed to select developers and are not generally available, and Apple’s ecosystem is much more restrictive by comparison.”

But Alexa’s voice-assistant market domination of a category still experiencing hockey stick growth may be short-lived.

See: Alexa, Google Assistant On A Collision Course

According to Parks Associates, Google Home sales grew by more than 165 percent year over year for the first three quarters of 2018, compared with the first three quarters of 2017. During the same period, however, global Echo sales were relatively flat, with an estimated growth of only 5 percent.

Two factors could tilt the voice assistant balance of power one way or the other.

First, Google’s potential long-term advantage may be its “integration with other widely adopted Google products, particularly the Android operating system, Gmail, YouTube and Chromecast,” explained Kristen Hanich, Parks Associates research analyst.

“Google has access to over 20 years of search data and access to more than 50 million voice samples, leveraged from its Android platforms, which can ultimately be used for machine learning,” opines Jonathan Collins, research director at ABI Research. “The Google knowledge graph is the most extensive created, providing access to approximately 70 billion facts that have been collectively grouped for link prediction. This extensive database drives the Google Assistant, along with Google’s extensive knowledge of interpreting textual search data that allows the Google Assistant to interpret semantics so well.”

Related: Speaking Out On Voice Assistant Adoption

“Google’s pace of developing localized language versions of its assistant, coupled with its duopoly on search and advertising, should result in it being about to scale its platform much larger than Amazon in the future,” added David Watkins, director of intelligent home practice for Strategy Analytics.

The second factor that could potentially reshape the voice assistant war is the growing interest in shop-by-voice, currently dominated by Amazon. “Shop-by-voice has more potential in terms of subscriptions, digital goods and consumables, and gaming experiences than physical products,” Hanich asserted.

But, “voice shopping has yet to really take off,” Watkins admitted. “When it does, Amazon will be in a very strong position to offer an ultimate end-to-end shopping experience thanks to its Cloud infrastructure, Prime delivery service and recent acquisitions in home access and security companies such as Ring.”

See: V-Commerce To Find Its Voice In 2019

However, in August 2017, Google added Walmart as a shopping partner. “Voice command shopping capabilities, as well as automatic repetitive orders — e.g., coffee and razor blades — are quickly becoming key differentiators among leaders in the market,” noted IDC’s Wright, “and Google’s partnership with Walmart will likely strengthen its position in this respect.”

And earlier this year, Google introduced its Shopping Actions program, which makes it easier to search and add items to a shopping cart, now optimized for Google Home smart speakers. “Google now has more than 50 store partners in the U.S., so it’s clearly trying to build an alternative voice shopping platform to Amazon,” Watkins argued.

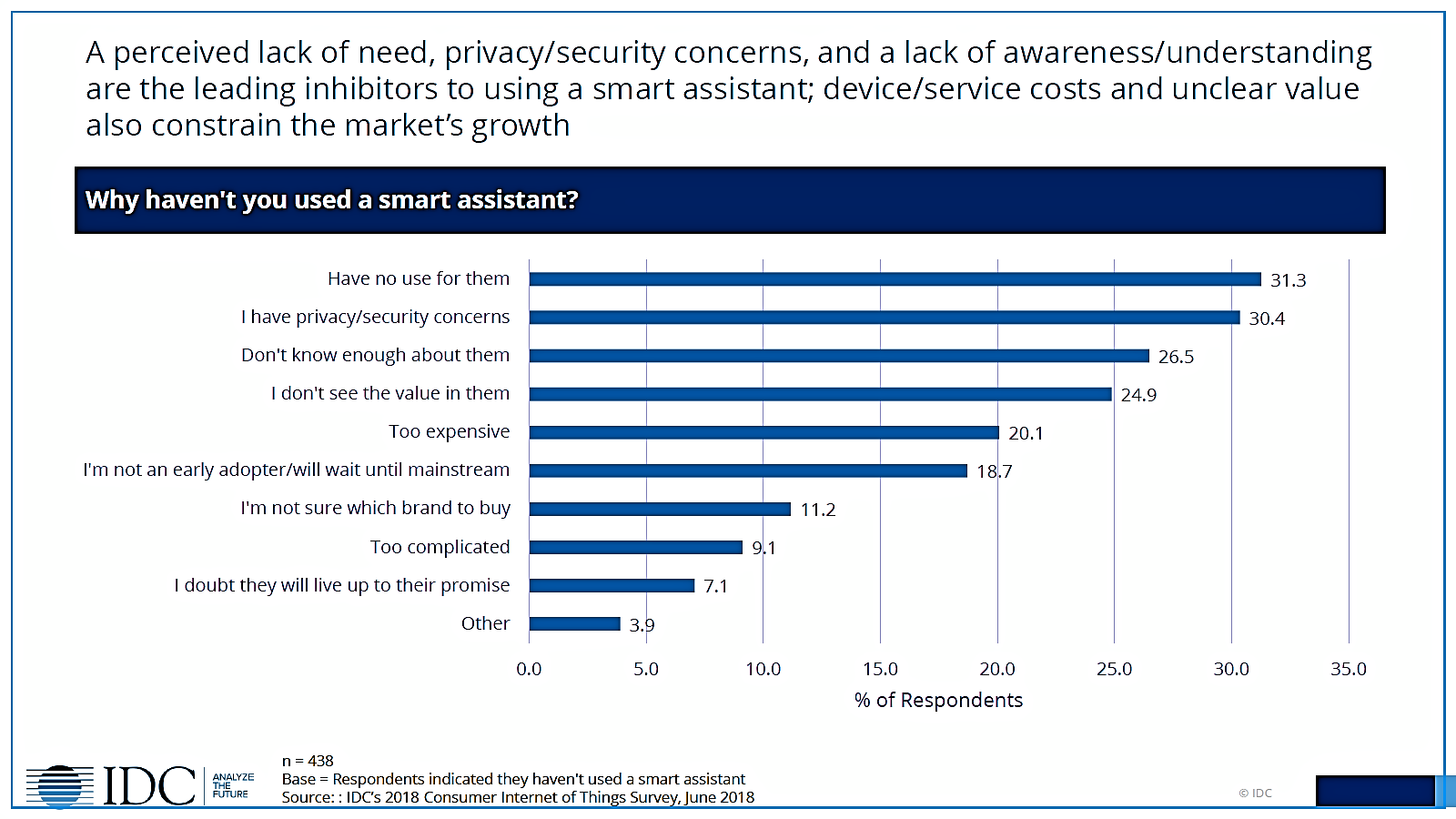

One overarching voice assistant concern is consumer data security and privacy. According to a recent IDC consumer IoT survey, 30.4 percent of respondents cited privacy and security concerns as a voice-assisted device purchase inhibitor.

Related: Alexa, Be My Friend

“Consumers have a misunderstanding of how voice assistant devices are listening. Rather than always listening, these devices are always listening for a wake word. Once the wake word is uttered, that is when the device begins to listen and process the voice query,” explained Parks Associates research analyst Dina Abdelrazik. “Companies must be able to convey this to ease consumers’ privacy and security concerns. Transparency and control of the data that is collected as well is important for consumers to feel like they are in control and feel a sense of trust.”