New York — SiriusXM posted a 15 percent gain in first-quarter net income to $124 million on a 12 percent rise in revenues to $897 million and a 12 percent jump in net new subscribers to 453,000.

The subscriber additions were the highest of any first quarter since Sirius and XM merged in 2008, in part because of growing reactivations of OEM satellite radios in used cars.

The first-quarter subscriber additions boosted the company’s subscriber base to a record 24.4 million, up 9 percent from the year-ago quarter.

The number of net new self-paid subscribers, however, grew only slightly to 304,000 from the year-ago 299,000. Those numbers exclude consumers on free and paid-for trial subscriptions. The base of self-pay subscribers rose to 19.9 million.

Average revenue per subscriber grew 2.4 percent to $12.05 from a year-ago $11.77, while the company reduced subscriber acquisition costs by 15 percent from the year-ago quarter to an average $51 from $60. Average monthly churn by self-pay subscribers rose slightly to 2 percent from a year-ago 1.9 percent.

Free cash flow grew to a new first-quarter record since the merger to $142 million compared with a year-ago $15 million. The gain prompted the company to upwardly revise expected 2013 full-year free cash flow to $915 million, up 29 percent from 2012.

The company, however, didn’t change its full-year guidance of 1.4 million net new subscribers and a 10 percent revenue gain to $3.7 billion.

The conversion rate of new-car buyers to self-pay subscriptions from free promotional subscriptions slipped slightly to 44 percent from a year-ago 45 percent.

New CEO Jim Meyer expects future subscriber gains to come not only from still-higher penetration in new cars but also from growing reactivations in used cars.

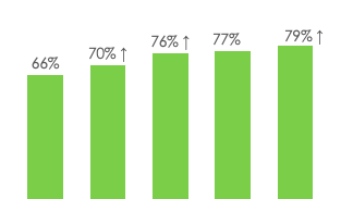

Satellite-radio penetration in new cars hit 67 percent in the first quarter, consistent with the rate in all of 2012, but Meyer said the penetration rate will grow as the company gains penetration among certain Asian automakers.

The company’s potential in the used-car market is growing rapidly, he continued, contending that, “in a few years, more used cars will be sold with [OEM] satellite radio vs. new cars.”

In 2012, he noted, the company obtained more than 1 million self-pay net new subscribers through the used-car market, and the company expects that number to grow to 1.5 million net additions in 2013.

The used-car market holds great potential, he said, because more than 52 million vehicles on the road are now equipped with satellite radio, up from a year-ago 42 million, accounting for 22 percent of all of the more than 200 million registered vehicles on the road.

Meyer expects the number of satellite-radio-equipped vehicles on the road to grow to about 100 million by the end of 2017 and to150 million vehicles in 10 years.

When you factor in used car sales, car sales in the U.S. exceed 50 million, he noted. That contrasts with expected 2013 new-car sales of 15.4 million, which will be up 6 percent from 2012.

The company “is reprioritizing lots of our resources” to focus in the used-car market, Meyer said, and the company will test multiple strategies to reach the new customer, who is “potentially more price-sensitive” than new-car buyers because of their different economic status and age.

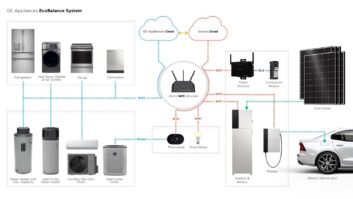

Future growth will also be driven by the company’s efforts to enter the telematics market and bring its interactive satellite-radio app to connected cars with embedded 4G LTE cellular.

In other comments, Meyer said:

–He expects “several major OEMs” to begin offering satellite radio 2.0 service but didn’t specify a timetable.

–The company is working with several OEMs to deliver in-car apps to provide the company’s Internet-streaming services to connected cars with embedded OEM 4G LTE cellular.

–The company is in conversations with automakers to offer its telematics service platform, having previously signed a deal with Nissan. SiriusXM said it hopes it has the inside track in offering the services that Nissan will eventually provide to its customers.