Hollywood, Calif. — Despite the struggling economy, the U.S. flat-panel TV industry continues to flourish, according to research released at the DisplaySearch HDTV 2008 Conference here Tuesday.

“That indicates that demand is there and if pricing is right TV sales should remain strong,” Paul Gagnon, DisplaySearch North American TV research, said. “That is a positive indicator that if the economy turns around we should see even better things from the U.S. TV business.”

Gagnon said TV unit sales will continue to grow through the remainder of 2008, although at a slightly lower pace than in 2007, causing the research firm to revise its forecasts slightly upward. However, accelerated declines in average selling prices (ASPs) will challenge dollar volume growth.

TV shipment growth has been stimulated by the switch from analog to digital, the upgrading from SD to HD and thick sets to thin, and continually declining prices, he said.

The ASP peak is “probably coming in 2008,” Gagnon said, adding tight LCD supply kept 2007 and early 2008 prices up, but panel price declines will translate to lower set prices. Average screen size sales continue to climb, aided by falling prices, he added.

Global HD growth has been driven by the transition to flat-panel technologies, which are inherently HD, according to Gagnon, who predicted HD share reaching 80 percent by 2011.

Gagnon said the outlook for fourth-quarter pricing has been revised downward slightly, and has been reduced considerably from the beginning of the year.

Gagnon expects to see aggressive price moves in the fourth quarter, including $499 price points for 32-inch LCD TVs this holiday season and said that the activity in the hugely popular 32-inch screen size will be pivotal for other screen size segments as well. The 1080p HD segment, he said, is poised for the biggest price declines, especially in the 50-inch plasma category.

As panel prices continue to drop, the switch over from CRT to flat-panel sets will increase more rapidly, including emerging markets, he said.

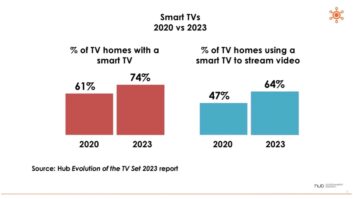

At retail in the United States, the share of TV sales by mass merchants continues to grow, showing “that we are about to enter a new phase of TV adoption,” he said. “Roughly … half of all U.S. households now have an HDTV, so the next wave of growth is going to come from those consumers who have been hanging on — the late majority.”

Activity in HDTV sales has led to increased adoption of pay-TV services, Gagnon said, with U.S. subscriber adoption almost doubling between 2006 and 2007.

Meanwhile, MPEG-4 capability is allowing content portability and new forms of TV viewing. This will create new opportunities, which may or may not be in HD, Gagnon said, and “HD vs. portability will be a major dilemma.”

In Blu-ray Disc adoption, the North American market is expected to be triggered by entry-level players close to $200 this holiday season, he said.

Some Chinese manufacturers have secured authorization from the Blu-ray Disc Association, he said. Branded players are likely to see ASPs of around $300.

As this occurs, the PlayStation3 gaming console will lose its position as a budget Blu-ray player by 2010 as it is undercut by dedicated players, Gagnon said.