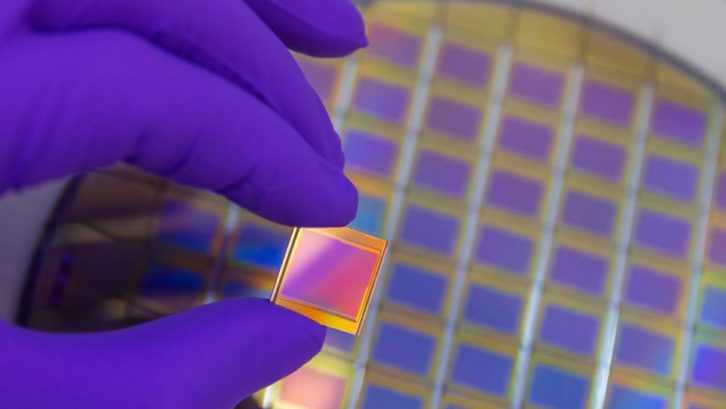

Semiconductor chips are everywhere in consumer devices, including refrigerators, electric vehicles, and even skateboards. This growing usage of chips to accelerate innovation in consumer electronics, combined with supply chain shocks that cause fluctuations in the supply and demand of electronic components, feeds the need for the U.S. to make investments to increase chip fabrication (fab) capacity.

While the CHIPS and Science Act indeed puts the U.S. on a path towards increased fab capacity for chip research, manufacturing, and development, impacts will not necessarily be immediately felt by consumers who are still waiting six months for the arrival of a new car. The U.S. currently hosts just 12% of the world’s global chip fab capacity, while the majority of fab capacity is located in Asia. Places like Taiwan and Korea make up a fifth of capacity and China, which holds the most capacity, plans to invest $1.4 trillion between 2020 and 2025 in the development of advanced technologies like semiconductors.

As such, transitioning reliance on fabs based in Asia will not be an overnight process for the U.S. and other countries. However, there is much to remain excited about in looking forward to the impacts of the CHIPS and Science Act. Here are a couple of ways the CHIPS Act will benefit the availability of semiconductor chips for consumer devices currently being impacted by supply chain shortages.

Increase the U.S.’s capabilities for the production of advanced chips

Basic chips, also known as legacy chips, account for much of the recent supply chain shortages. The CHIPS and Science Act gives the U.S. a leg up in the production of newer, complex chips that power smartphones, data centers, supercomputers, and cutting-edge military equipment like unmanned aerial and marine vehicles. In the future, we’ll be able to transition reliance away from legacy chips with increased availability of more complex chips in the U.S. This is especially beneficial to support the growing demand for electric vehicles (EV), as the average EV requires 3,000 chips for production, which is twice the number of units used in traditional vehicles.

Improve ability to weather fluctuations in supply and demand

A majority of the advanced chips required to power smart devices applying innovative technologies like the Internet of Things (IoT) and 5G come from fabs based overseas in Asia. While after three years, China’s “zero-COVID” policy has ended, the impacts of the fab lockdowns on the global supply chain for electronic components are still being felt today when it comes to the availability of consumer devices. Over the course of the next few years, as more fabs pop up in the U.S., the U.S. market will be better positioned to weather shocks to the global supply chain and allow for even more innovation in consumer devices.

Near-term disruptions persist

Consumer-facing industries like automotive will continue to see supply chain disruption over the course of the next few months, but the longer-term outlook and investments made by the CHIPS and Science Act create optimism for a future that stimulates consumer electronics innovation in the U.S.

While investments from the CHIPS and Science Act will decrease the U.S.’s dependence on chip production in Asia, it won’t immediately solve supply chain issues. The development of fabs can take up to two years so the benefits of the investments will really begin to take shape over the course of the next decade.

About the Author

Paul Romano is the COO at Fusion Worldwide.