The home entertainment retail landscape was unique this year because most, if not all, of the alternatives to at-home entertainment experiences were taken off the board. Without concerts, movies, or many other live out-of-home events, folks were forced to spend more time than ever cooped up in their living rooms. Unable to spend disposable income on experiences or travel, they instead turned their dollars towards home entertainment products.

Though certainly accelerated by pandemic-era lifestyle shifts, the growth of the home entertainment retail sector did not start with the pandemic. Nor will dealers be satisfied if growth stagnates when COVID-19 subsides. They must find a way to stave off regression once society finally opens the doors. For 2021, retailers will not only be working to maintain 2020’s double-digit sales growth resulting from the pandemic, but they will also have to do so while battling the normal depreciation in Average Selling Prices (ASP) for the home entertainment category.

Staving off Regression on Multiple Fronts

While sales of home entertainment products are likely to decelerate once people can go outside again, there remains optimism that the prolonged time at home has given people a renewed – and lasting – appreciation for quality home entertainment solutions. Still, a deceleration of sales volume is hardly the only current dealers will forge against.

The consistent deflation in ASPs of home entertainment products presents dealers an equally intimidating challenge. For some products in particular, this deflation is stark. According to industry sources, heading into the COVID era of 2020, soundbar ASPs had fallen 8.6% for the first quarter to just over $212. And midway through the year, the average price for a 65-inch TV in the second quarter period was $644, around $200 lower than the same time a year ago.

There is a range of reasons for the enduring erosion of home entertainment ASPs within the context of 2020 and 2021. Two in particular that stand out prior to 2020 are the expansion of electronic equipment production in East Asian markets that dramatically increased the scale at which home entertainment products could be manufactured, and supply chain improvements that eased logistical burdens.

These factors took a backseat during the pandemic as many East Asian facilities halted production and nations limited international import/export. Once the pandemic subsides these efficiencies will return. Add to that the demands of a U.S. consumer market that has been trained to expect more for less when it comes to technology, plus the elimination of the windfall in sales that COVID provided, and retailers face a daunting task to reach 2021 revenue goals.

Higher-End Audio Offers Opportunity

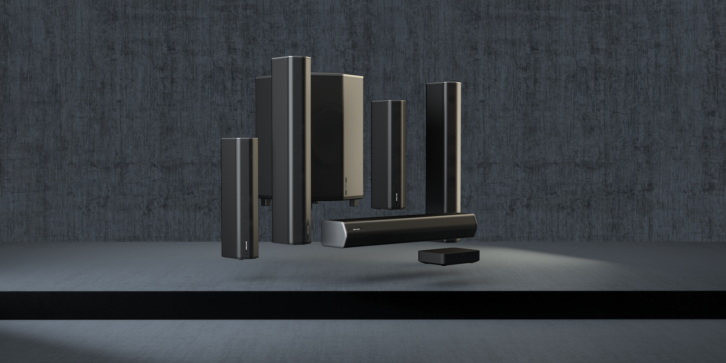

Offsetting shrinking ASPs and decelerating sales volume is a challenge without a singular solution, but high-end home audio equipment presents an alluring opportunity for dealers to stave off regression associated with entry-level home audio and other products like televisions. While the increased commoditization of entry-level home audio products like a soundbar allows consumers to sidestep dealer involvement, it is the equipment that is a performance step above that allows the dealers’ value to remain in place by demonstrating in their stores and educating on their websites. You can buy a soundbar practically anywhere. That is not the case for higher-end solutions. If a consumer is going to spend a thousand dollars or more on a home entertainment product, they want to protect their investment by purchasing through an authorized, reputable reseller.

The ASPs on this sort of equipment also exhibit far less precipitous deflation than televisions. On top of all that, the true theater-like surround listening experience of a high-quality home theater audio system is something an ordinary soundbar just cannot reproduce. Consumers are willing to pay for that experience. Given the same opportunity for exposure, products like the Enclave CineHome true wireless audio 5.1 surround systems sell at a rate of 2:1 on the THX PRO system versus the entry-level CII, with respective retails of $1599.98 and $1099.98. (They are also just as simple to set-up as a soundbar.)

Ultimately, the COVID-related spike to sales volume will ebb soon enough and shrinking ASPs for televisions and entry-level home entertainment equipment will sting as much as ever. Higher-end home audio solutions give dealers the opportunity to buttress themselves against the factors of ASP regression and COVID-era sales, while simultaneously providing customers with an experience they will surely appreciate.

See also: Enclave Audio Announces CineSync Program for On-Screen System Setup and Calibration