We all have a friend that is first to invest in the latest tech gadget, but the exponential growth in new, innovative products across the smart home sector — from smart toilets and kettles, to smart litter bins and curtains — has left many a technophile checking their bank balance.

From hundreds of exhibitors who released or upgraded smart home products at CES 2020 earlier this year, to the smart home movers and shakers who greeted visitors at ISE in Amsterdam with their one-stop-shop smart home offering, the proliferation of new smart home products, connected to the IoT, has been startling. This has been further amplified by major tech heavyweights, including Amazon and Google, now offering comprehensive smart home offerings. But how far are we from smart, interoperable homes becoming the norm? And more importantly, what are the challenges that stand in the industry’s way?

Interoperability — Addressing the Perennial Issue

Smart home standards have been a hindrance to the industry’s development for several years now. A lack of a coherent and unified communication standard has been a perennial issue, creating barriers for interoperability and a streamlined smart home experience. The market remains split between different wireless communications protocols, most notably Zigbee and Z-Wave, which are both considered as capable mesh networks. The enticing opportunity for tech companies to create their own proprietary ecosystems has left the market even more fragmented.

There are signs that 2020 may signal a change to this. In late 2019, Google, Amazon, Apple, and Zigbee Alliance joined forces to work on a new connectivity standard through a working group — Connected Home over IP — to improve interoperability. The group has taken an open-source approach for the development and implementation of a new, unified connectivity protocol. Moreover, Zigbee Alliance recently announced IKEA has joined its Board of Directors, which already boasts Legrand, Samsung Smart Things, Signify, and Schneider Electrics. Subsequently, Z-Wave Alliance announced plans in December 2019 to open their standard to all silicon and stack vendors for development.

Competition — the usual cornerstone to improved processes and new inventions — has not benefited the sector thus far. Whether the recent announcements will bring greater collaboration and openness between the different protocols will be pivotal to the speed at which the sector evolves.

The Gateway Products: Accessing the Market

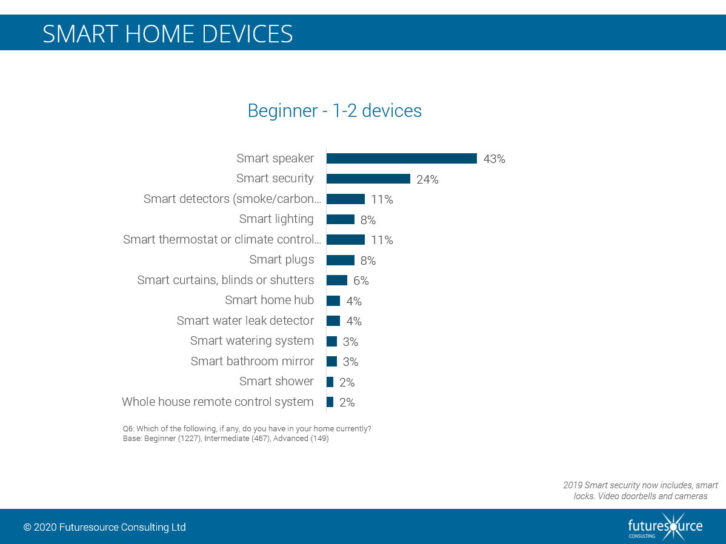

Futuresource’s ‘Smart Home Consumer Survey’, released in November 2019, revealed that 47 percent of people in the United States, United Kingdom, France, and Germany now own a smart device (see figure 1 for relevant smart devices; smartphones and smart TVs, for example, are not included), up from 33 percent in 2018. The lion’s share of growth in 2019 has been down to a sizeable increase in smart speaker and smart security purchases. This, for the smart home ecosystem, is a very encouraging sign as smart speakers, primarily, as well as smart security, are the gateway products into the smart home world for many consumers. When analyzing the purchase journey of consumers new to smart home devices (beginners with 1-2 devices), 43 percent had smart speakers and 24 percent had smart security devices, with all other smart home categories ranking 11 percent or lower (see figure 1).

The easy affordability of smart speakers since they were launched in 2014 has been a key reason for their growing role in the home and is why they will continue playing a pivotal role in helping the smart home industry access the mainstream audience. According to Futuresource’s ‘Home Audio Quarterly Tracker’, 84 percent of smart speaker sales in 2019 cost under $70, globally. Leading the way are the Amazon Echo Dot — retailing for as little as $22 during Black Friday deals — Baidu’s Xiaodu, and Google’s Nest Mini. Despite having an average retail price of $178 in 2019, smart security, which includes smart video doorbells, cameras, and locks, is also becoming increasingly affordable driven by greater industry competition, as acquisitions and organic growth further expands Amazon (Ring), Google (Nest), and Samsung’s footprint in the space.

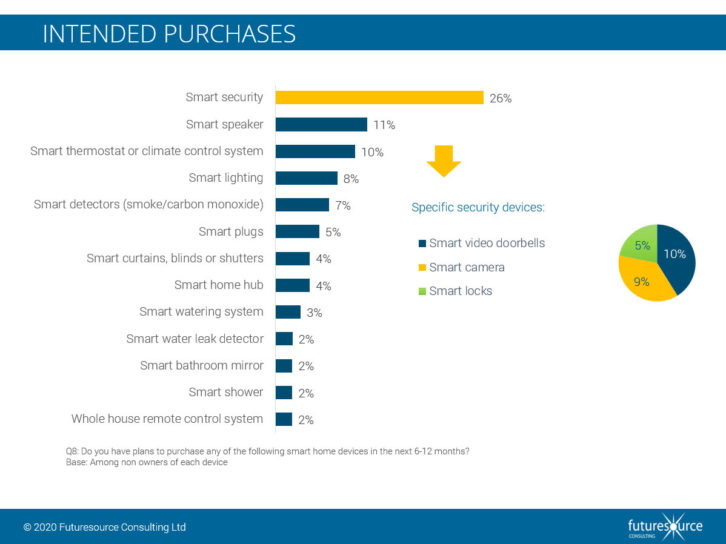

Looking ahead, the future looks encouraging for the sector, as the adoption of these gateway products will continue growing. 26 percent and 11 percent of customers that currently do not own a smart product intend to invest in smart security and smart speakers respectively over the coming 6 to 12 months (see figure 2).

Convincing the Cynic

Despite our belief that the smart home sector will outperform most other consumer device segments and achieve a global value CAGR of 22 percent between 2019 to 2023 (smart home devices, excluding smart speakers), producers will need to address perpetual consumer concerns if smart home devices are to break into the mainstream in the coming year.

There have already been encouraging trends regarding consumer awareness of smart home devices; 50 percent of consumers stated high product cost and 29 percent underlined lack of effective use cases as reasons for not purchasing in 2019, down from 55 percent and 38 percent respectively in 2018. However, concerns over security and privacy of smart products have remained the same over the past year across smart home devices. Indeed, privacy issues surrounding smart home devices, especially around the leaking and sharing of data, have dominated media headlines over the past couple of years.

The cost of smart home devices will continue to fall and the usage cases will only become more compelling, especially with respect to assisted living, but the industry must present a smart home offering that guarantees its customers’ privacy and security. That will happen only through collaboration between smart home device vendors — which is of added importance given that it only takes one vulnerable device in a smart home network to compromise overall security. Close attention to privacy issues and effective legislation will be required, in addition to adopting best practices for issuing software security updates for products already in the field. As we have seen across the tech space in recent times, one mistake will be enough to set the industry back.

The new decade will see our homes become ever smarter, led by the growing affordability of gateway smart home products. Although, if the industry is to break into the mainstream in the coming year, it must form a greater level of cohesion that allows for increased interoperability across devices and that guarantees customer security without the need for over regulation. Our homes are our last place of private refuge, and we will want it to remain that way.

Further details on how smart home adoption is set to change in the coming years and what is driving consumer behaviour can be found in Futuresource’s ‘Smart Home Devices & Appliances: Consumer Ownership and Attitudes’ report.

For more information, visit www.futuresource-consulting.com.

This article originally ran on residentialsystems.com.

See also: Evolving The Retail Experience In The Age Of The Smart Home