Denon is targeting a minimum 10 percent sales gain in the 2008 fiscal year ending next March and expects to win top A/V receiver (AVR) dollar share for the first time during the period, company executives said here during a national rep event.

To achieve those goals, the company said it plans to be first to offer Audyssey’s Dynamic Volume technology, which appears in all 10 new AVRs starting at a suggested $299. The technology maintains a consistent volume level and flat frequency response when a TV program cuts to a commercial, when a TV channel changes, when video sources are switched, and when a movie or TV soundtrack transitions to softer or louder passages. The technology also kicks in when a program transitions to louder or softer passages, and it maintains an enveloping surround-sound experience during softer passages.

Denon is also pushing key AVR features down to lower price points, with the starting price of Dolby TrueHD and DTS HD Master decoding falling to a suggested $599 from $1,199. The 1080p up-scaling feature starts at $599 instead of $849.

The supplier’s Blu-ray line has expanded to three SKUs with a $749-suggested Profile 1.1 player with 24 fps output, HDMI 1.3a, improved load and play times, and decoding of all Blu-ray surround formats. It ships in October to join a current $1,999 player and a $1,199 Blu-ray transport, also offering those features. Additional players planned for introduction later in the fiscal year will include the brand’s first Profile 2.0 models.

To further increase rising sales of eight networked-audio devices introduced last year Denon is launching online sales training to support the devices and offering a floor-standing demo station and shelf talkers to clarify the network concept to consumers. Denon wants to place the demonstrators, equipped with flat-panel monitors, in a couple hundred storefronts at its own expense. Expanded distribution after a late launch will also boost sales, the company said.

The company said it is encouraging retailers to “put audio in the forefront in the store” and no longer treat it as a video attachment to be mentioned after a TV is sold, said senior sales and marketing VP Joseph Stinziano. “We will attempt to drive this change” with training, POP material and advertising, he said, particularly trade advertising to installers to reach a new generation of people who are selling audio to consumers.

In the AVR segment, the three pillars of the company’s product and marketing strategy, Stinziano said, are:

- Connectivity, or compatible connections to other products via HDMI, Ethernet, and other connections;

- Ease of use and enjoyment via such technologies as Dynamic Volume and basic HDMI CEC, which Denon is adopting for the first time. It appears in all 10 new AVRs and in the new Blu-ray player;

- And reproduction of audio and video as the artist intended, thanks to such technologies as compressed-audio restorer and automatic room-acoustics correction.

In the previous fiscal year, Denon benefited from a strong AVR lineup and its entry into new categories.

Among those were Denon’s first virtual surround bar, universal remotes, iPod-docking networked music systems, and iPod-docking digital media adapters, Stinziano said. Nonetheless, a rocky economy and late shipments of multiple products yielded a small decline in Denon sales during the fiscal year ending March 31, he said.

Stinziano forecasts a minimum 10 percent sales gain in the current fiscal year, however, for several reasons including improved product availability, more Blu-ray SKUs, improved Blu-ray availability, and Blu-ray’s impact on AVR sales. “Our AVR sales improve when Blu-ray is in the stores,” Stinziano said.

Perhaps a more critical factor in Denon’s sales forecasts is the company’s expectation that its AVRs will gain share in the sub-$1,000 price range because of improved competitiveness. “Above $1,000, we’ve always been No. 1 in dollars,” he said. “Below $1,000, we had a very good year last year, but this year we’ll get better compared to the competition.”

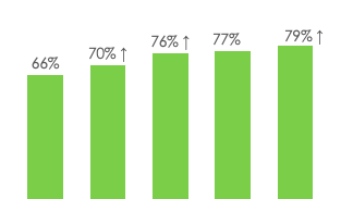

Already, he said, NPD statistics showed Denon besting Yamaha in AVR sales for the first time in February and March 2008. In fiscal 2007, Denon put its second-place AVR dollar share at 20.1 percent, and it’s targeting a 23 percent share in fiscal 2008 ending next March, Stinziano said.

Denon also forecasts industry-wide factory-level sales gains of 2 percent to $735 million in receivers and amps in calendar 2008 and a 113 percent gain in optical disc players to $856 million, including Blu-ray Disc players.

Executives from Denon and parent D&M Holdings declined comment on reports that D&M’s largest shareholder plans to sell its 49 percent stake in the company.