Chicago – New Age

Electronics held its first Dealer Summit here this week, drawing 25 suppliers

and 60 retailers to review products and discuss market trends as attention

turns to the fall.

Fred Towns,

president of New Age Electronics, a division of Synnex, told TWICE the goal of

the Wednesday through Friday Summit is to “look at the fall selling season and

say to customers, ‘Are you prepared?’ And if not, there is still time.”

Towns said that

New Age brought together “what we believe are some of the hot categories”

starting with tablets and including video games, which is a specialty of Jack

of All Trades, the Synnex game division.

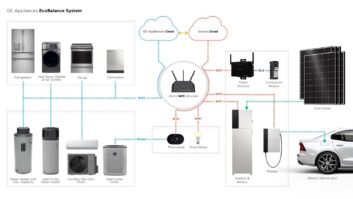

Kevin Murai,

president/CEO of Synnex, which reported strong double-digit year-on-year sales

growth, said that the emphasis of the $8.6 billion parent company is “the Cloud,

mobility and the converged home.”

He noted that 20

percent of Synnex annual sales are from New Age, and he claimed that makes it

“the largest CE distributor in the U.S.”

The tablet market

received special emphasis at the Summit, with Towns commenting that he knew

last holiday season that the category was going to take off this year. “We saw

very few third-party tablets, but we sold anything we could get our hands on,

and they went out the door.”

This year, since

New Age does not carry Apple, “We wanted to make sure we at least had best of

class. We want to make sure our retailers have as many good choices as

possible. We want them to understand the market and make sure they can partner

with right brands so they can be successful.”

As part of a

special panel discussion at the Summit, Acer, Hewlett-Packard and Motorola were

in attendance, along with Microsoft and McAfee. (See next week for more

coverage on that panel.)

When asked how

important it is for retailers that don’t carry computers to enter the tablet

market, Towns said, “Consumers have found out how [tablets] work great with

existing [home] systems. They can be used in a smart home setting, to control

lighting, audio/video and security, yet they are still tablets. They are

reaching the whole world of entertainment.”

He noted that when

you see “Best Buy downsizing their stores, what will they [and other retailers]

do with the extra space?” He suggested that Best Buy and other retailers that

may be dropping other categories may “reposition their stores and put [tablets]

there so they can touch and play with them” in a streamlined setting.

Towns acknowledged

the slow summer sales at retail for a second year in a row, and noted it is

because retailers “are not carrying a ridiculous amount of inventory” and being

“careful to make manageable turns” while consumers “are being penny-wise and

cautious” waiting for deals.

“Some dealers have

been saying ‘maybe I will delay by back-to-school computer promotions’ because

they are still selling spring product. Some of them are in a better, healthier

position now to take goods in due to that strategy,” he noted.

In discussing the

general economic situation and how it is affecting consumer shopping habits,

Towns suggested that stimulus packages, “like last year’s major appliance

effect to buy more energy efficient products, were very successful.”

He noted that

while states are “challenged with getting taxes on the retail side ” due to the

loss of revenue from Internet sales, if that can be solved, some states could

afford to cut sales taxes around certain periods like Black Friday, which would

increase retail sales and economic activity. It could be a win-win.”

Towns also noted

that supply-chain problems due to the disaster in Japan have been handled for

the most part by suppliers, except for printing type products and some higher-end

camera categories. In the camera category, the supply problems, “helped bring

more value” to the category.

As for the overall

holiday season in CE, Towns sees single-digit growth for many individual

categories.

In TV, Towns mentioned

an opportunity in the 37-inch to 42-inch market where “there are still a lot of

old tube sets being used,” at homes and businesses. Some consumers won’t go for

a larger set because “they don’t want to get rid of furniture for them.”

What he suggests

is for retailers to partner with local recyclers and “take back old TVs, give

consumers credit for the units to be recycled and sell them new HD sets. It is

an opportunity you could do in the mid-price-point part of the market.”