News of Haier Group’s intention to acquire GE’s appliance unit, in lieu of a prior deal with Electrolux, could have a profound effect on Haier, GE, and the U.S. and global majap markets.

Here, Dinesh Kithany, home appliances senior analyst for market research firm IHS Technology, outlines the potential impact of the $5.4 billion buyout, set to close midyear.

Haier’s perseverance to acquire GE Appliances finally seems to be paying off, so it could now be time for Haier to shift gears and become more aggressive in the marketplace.

This acquisition would not only increase Haier’s footprint in the U.S. and global markets, but would also change the overall landscape of the global home appliance market, including the U.S.

The following are possible outcomes in the U.S. and global home appliances markets, if this acquisition receives regulatory approval:

Haier might take the GE brand global: This acquisition allows Haier to use GE’s “Made in America” brand for 40 years. And there is a possibility Haier might take the GE brand global.

Haier gains share of the premium segment: With the GE Appliance brand, Haier would immediately gain a major share of the premium segment of the home appliance market, a positioning that Haier is finding it difficult to achieve.

Haier also gains share and expertise in the “builders” segment: Haier would suddenly become a key player within the U.S. builders segment, not only promoting the well-established GE brand, but also leveraging the acquisition benefits and promoting its own Haier brand among a new audience of builders, property managers and architects. With this added expertise, Haier would also grow its share among the builders segment in other regions.

Haier to retain GE business in totality: This acquisition may not result in any closed factories or employee lay-offs. Haier Group (Qingdao Haier) would continue to adopt a decentralized management style developed by founder, chairman and CEO Zhang Ruimin.

It would also provide GE Appliance the same level of management independence and empowerment as it does with its recently acquired appliance company Fisher & Paykel, which appears to be sailing quite smoothly.

Haier gains GE expertise and access to its loyal customer base: Aside from GE’s large, loyal customer base, Haier would also get access to GE’s large supplier and distribution network in the U.S.

Haier becomes a consumer electronics giant. Haier has gradually tried to increase its business beyond the home appliance market, launching smartphones, smartwatches, tablets, smart TVs and other consumer electronic devices. With access to the largest and wealthiest consumer electronics market, Haier’s ambition could be achieved sooner than expected.

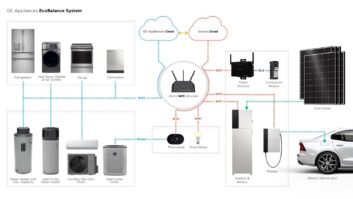

Haier’s transformation into a technology company: Haier has been reasonably successful in promoting its smart, connected appliances in China, and the company would further gain from GE Appliances’ cutting-edge technological standards by leveraging them into some breakthrough developments in the connectivity segment, due to GE’s decade of expertise in this area.

Haier becomes a key strategic partner with GE Group: Aside from the $5.4 billion purchase offer by Haier to acquire GE’s appliance business, Haier gains even more value in being a strategic partner with the wider GE Group — jointly expanding into automotive, healthcare, industrial Internet, advanced manufacturing and other high-tech industry sectors.

Change in the overall market landscape: Post-acquisition, the market dynamics and the landscape of the home appliance market would change in the U.S. and globally, as Haier, Midea, Hisense and other Asian players get aggressive to gain market share. This would encourage Whirlpool, Electrolux, Bosch, Arcelik and other Western players to respond accordingly.

Haier may replicate its TV strategy: An example of how aggressive Haier can get can be seen in its recent approach in the Korean TV market, where it launched lower-priced TVs with updated technology against global stalwarts Samsung and LG.

Haier may take the lead in the display market: Haier’s entry into the TV business could also affect how display technology would be used in home appliances. Use of display technology in home appliances, which is already set to evolve rapidly, would grow faster as appliance makers use more and larger multi-color and touch-sensitive displays to differentiate their producdts.

Finally, following the sell-off of the GE Appliances business, there will not be many companies left to acquire. It will be interesting to see the strategies appliance makers come up with to gain market share post-acquisition.

Dinesh Kithany is home appliances senior analyst for market research firm IHS Technology