The TWICE Top 100 Major Appliance Retailers Report makes some big news today with Lowe’s becoming the No. 1 retailer for the category, replacing Sears, which has been the No. 1 white-goods dealer since this report, and any similar report, began being published.

Sears, the leviathan of major appliances for years due to the strength of its Kenmore brand and its stranglehold on top brands and the American public, finally lost its grip on the top spot.

Does this mean that the feared prediction of the last decade or so by independent appliance dealers, that the “lumberyards,” as some disparagingly call Lowe’s (with an 11.3 percent gain in sales) and The Home Depot (with a 15.7 percent increase) will now take over the major appliance business?

Did Sears mismanage itself out of the leadership position in major appliances? Was savvy merchandising and marketing the reason why Lowe’s, Home Depot and others gain double-digit market share? Or were there other factors at work?

Like anything about retail, nothing is ever black and white, with the truth appearing in the gray area.

Granted, Sears has mismanaged many categories and been challenged by competitors, but if you look at our report closely, 2013 is the first full calendar year that Sears (No. 2 with $4.967 billion in sales) and its former division, Sears Hometown Store (No. 5 with $1.64 billion) operated as separate companies. Together they have $6.6 billion in 2013 sales, which if the spinoff didn’t happen, would have kept Sears atop the Top 100.

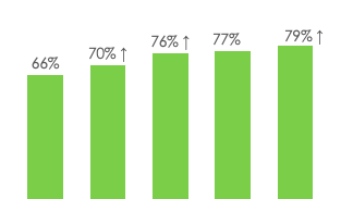

So is this all due to the spinoff? Well … no. Yet Sears’ sales dropped 1.2 percent during the year. And while Sears Hometown Store registered a gain of 2.5 percent, it is during a year when major appliance sales have rebounded, with the Top 100’s growth up 9.1 percent in 2013.

Aside from Lowe’s and Home Depot registering double-digit sales gains in 2013, Best Buy was up 17.8 percent; Conn’s continued its transformation and had a 30 percent gain; Abt was up 17.9 percent; Nebraska Furniture Mart’s sales rose 15 percent; and P.C. Richard & Son, R.C. Willey and hhgregg, among others, registered strong single-digit gains.

Buying groups that are filled with independent retailers — electronics, appliances, furniture and combinations thereof — have all leaned on the category for volume and profitability, with the rebound in housing sales and pent-up demand for white goods after the prolonged economic downturn.

The problems of Sears, an icon in American retailing and in major appliances, are sad to witness, but the situation does not reflect the popularity and growth potential of the white-goods business.

That popularity is helping not only national chains and “lumberyards” but regional players and smaller independents survive and thrive in a changing retail landscape.

This originally appeared in TWICE’s June 16 print issue.