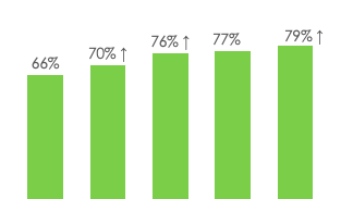

The average person spends approximately $3,800 a year on connected tech — and $800 of that is on hardware alone.

But even though consumers are dropping huge chunks of change on new gadgets, they’re often neglecting to protect their investment. And a lack of protection often leads to a costly replacement.

Just imagine what consumers could be buying instead of replacing that unprotected device. Better yet, skip imagining it, and check out this short list of alternatives below:

*Apple MacBook ($1,300): One month’s rent for a studio apartment in Los Angeles;

*Amazon Kindle Fire HD ($150): 52 Starbucks lattes

*Samsung Galaxy S7 ($672): One night in a suite at the five-star Savoy Hotel in London;

*Apple iPhone 6s ($649): A Jamaican dolphin adventure and sunset cruise for three;

*Samsung 40-inch TV ($300): 75 Big Macs from McDonald’s;

*AT&T MiFi Liberate 4G Mobile Hotspot ($50): A one-hour massage; and

*Apple iPad Pro ($950): Two round-trip plane tickets from New York to Bermuda.

Of course, no one would buy 75 Big Macs in one sitting (at least we hope not for the sake of their health), but it really puts the kind of cash we’re dropping on tech purchases into perspective. And who wouldn’t want to swim with the dolphins and cruise the ocean with some friends instead of having to replace a broken iPhone?

That’s where warranty solutions come in. Believe it or not, spending a little extra on device protection each month can help prevent customers from draining their vacation (or latte) savings on one, big, avoidable purchase. Even if they aren’t particularly clumsy people, accidents happen all the time that aren’t covered by manufacturer warranties.

So, let your customers know that the next time they give their kid the iPad, knock over a glass near their Galaxy, or click the link that corrupts their MacBook, they can still breathe easy (and pay for life’s little luxuries) thanks to the protection of a warranty solution.

Kevin Cundiff is retail VP for Fortegra Financial (a Tiptree Financial company), a single-source insurance services provider that offers a range of consumer protection options including warranty solutions, credit insurance, and specialty underwriting programs.