While the rare solar eclipse was locally obscured by overcast skies and random drizzle, there was no shadow last week on the Nationwide Marketing Group’s annual PrimeTime event in Las Vegas. With market conditions in a perpetual state of flux, more than 3,000 attendees from 750 companies, along with over 200 vendors convened to set their product and marketing direction.

In the wake of Sears contracting, the bankruptcy of hhgregg and the availability of Kenmore appliances from Amazon, the timing was right to evaluate and update marketing initiatives, examine new product opportunities and explore the impact of new technologies.

The Nationwide executives we spoke with painted a positive picture with member business said to be up 19 percent in CE, with an ASP $360 over the combined total retail average. Driving that is a strong emphasis on 4K Ultra HD.

Nationwide’s executive team and staff pose before the opening of the PrimeTime events.

On the appliance side, concerns were expressed about both the growth of retail stores and Amazon, but the group emphasized the ability of the independent to be more agile across a wider range of models and brands with delivery and installation among the arrows in their quiver. According to Nationwide’s Jeff Knock, “Members’ business is up significantly when a Sears closes.”

However, not waiting to simply wait for the business to come to their members, Nationwide is working on many fronts. With the claim of a 75 percent close rate once a potential customer comes into a store, driving traffic is key. Capitalizing on the retail turmoil, the group’s earlier “Prepare for Share” campaign and its slogan of “Bigger isn’t Better … Better is Better” is morphing into “Take Your Share,” backed by a variety of marketing components, including broadcast and social-media ads and promotions.

Part of the overall effort to drive traffic against e-commerce and online advertising will be a special effort to expand awareness for the independent outlets among millennials. A strong emphasis on point-of-sale analytics will also be key to this. Video, produced by Nationwide’s in-house production unit as well as from vendors, will be a big push. As one Nationwide exec told us: “If a picture is worth a thousand words, a video is worth a million pictures.”

LG’s Smart ThinQ system ties a full range of kitchen appliances together into a unified system.

Despite rumbles in the news over economic issues, tax reform and a potential battle of spending limits and the budget, all categories were up through the summer, and there was a positive outlook for back-to-school and into the holidays. Driving that will be a continued push behind 4K Ultra HD, with QLED and OLED having strong presences at the vendor booths.

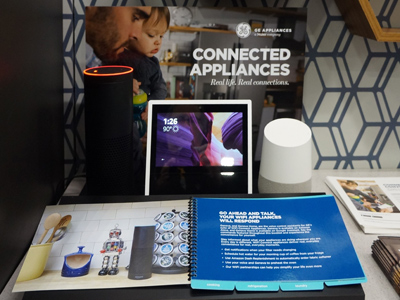

With Ultra HD as a hot button to lift members out of commodity-priced TVs, connected kitchen was virtually everywhere on the appliance side. The most visible evidence of that was the presence of both manufacturer-specific smart-home systems, such as LG’s ThinQ, and more generic connected architectures with Amazon Alexa and Google Home as the central control point. Both devices were highly visible in all the majors’ displays.

Bridging product and marketing, PrimeTime was the coming out party for the partnership between Nationwide and Nest Labs, first announced in March. With extensive use of voice control for more than just music, answering search questions and such, the Nest and Works with Nest initiative was highlighted in a Connected Home display with this arrangement bringing “an advanced and consumer favored lineup … for dealers who are finding success in this growing category,” said Nationwide’s Tom Hickman.

Responding to TWICE’s question about the need for advanced training to wrangle the wide variety of brands and products that must be taught to work together, it was clear that this, too, would be a high-focus area in the year ahead. Specialty dealers in the HTSN group are more likely to be CEDIA members and already versed in the intricacies; others will take advantage of training to catch up.

Even the bedding market has connected products.

The takeaway from many of the demonstrations, such as those by GE/Haier, was not only single point-to-point commands, but the ability to create a multi-tiered task such as a Nest smoke alarm “talking” to a range’s cooktop to turn off the burners and turn on a range hood. Given likelihood of some “babelization,” more than one supplier mentioned IFTTT as a potential bridge between disparate brands and products. Monitoring of device activity was also mentioned as a potential revenue product, particularly with the projected growth of multi-device sales.

Emphasizing that smart devices and IoT are a key to the future for more than stratospheric-priced sales, there were also a few products on the bedding side to measure sleep and potentially connect with other connected devices. Indeed, bedding remains a very active part of Nationwide’s members’ activities. While some might see bedding as at odds with CE and appliances, at least two of the major mattress groups were pitching small-footprint bedding departments. As an example, figures from Serta Simmons pointed to 650 square feet devoted to mattress sales — about eight units on the floor — should deliver more gross profit dollars than 1,600 square feet devoted to appliances with blended gross profit margins from 48 percent to 54 percent. Perhaps not a strategy for every outlet, but an interesting notion nonetheless.

At the end of the day, with programs in place to train against new competition — to both capitalize on new opportunities created by changes in the retail picture while defending against big-box chains that are also primed to take advantage of others’ distress — and an emphasis on social, online and video outreach, Nationwide’s event proved that it’s looking to create some heat in the market beyond the 100-plus temperatures in Las Vegas last week.

On the product side, higher-end Ultra HD TV, accessories that add additional margin to the ticket for a video sale, higher-line appliances and “connected everything” point to a good fall season and an optimistic outlook for the fourth quarter.

“Scan-to-Cook” is one example of integrating Internet connectivity with appliances to read bar codes and set cook times.

Of course, as with every retail initiative, the key remains the same basics as always: Bring traffic into the store and provide the products, promotions, financing programs, inventory, on-the-floor salesmanship, installation and follow-up.

Putting it all together was an obvious, but oft-ignored mantra. The constant theme throughout the 63 sessions and in conversations with numerous Nationwide executives was “Sell on Price, CRUSH on Service.”